If you own an LLC, S-corp, or C-corp, you probably have to file a new report this year. The Beneficial Ownership Information Report applies to most small businesses, and many impacted businesses will be LLCs. So if you own or have a controlling interest in an LLC, it’s critical that you understand the requirements and how to file.

Here’s what you need to know.

Key Dates to Remember

- If your business was established prior to January 1st, 2024, then you must file by January 1st, 2025.

- If you create a business during 2024, you have 90 days from creation to file the report.

- If you create a business after January 1st, 2025, you have 30 days from creation to file the report.

Table of Contents

What Is a Beneficial Ownership Information Report?

A Beneficial Information Report (BOI) provides the government with personal information about the individuals who benefit from a legal business entity. Its purpose is to make it easier to track and prosecute financial crimes and fraud, including money laundering, tax fraud, and fraud committed against other parties, including a company’s employees and customers.

The requirement to report beneficial ownership information came about as part of the Corporate Transparency Act of 2019. FinCen set final BOI regulations in September 2022, with reporting commencing on January 1, 2024.

Sole proprietors and partnership participants are excluded from BOI reporting, but you should check with your attorney or CPA to be 100% sure your business is exempt. Since 2024 is the first year when the filing of the BOI is required, the specific rules are not entirely clear. You should seek professional help in regard to your specific situation.

Who Is Required to File a BOI Report?

The reporting requirement extends to LLCs, S corporations, and C corporations. More specifically, the report must be filed by anyone who either directly or indirectly owns or controls at least 25% of the business or exercises substantial control over the business. Once again, reporting companies do not appear to include sole proprietors or partnership participants.

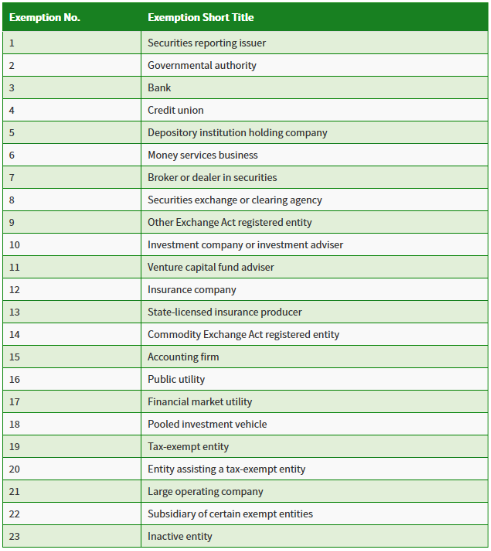

Otherwise, the law only provides exemptions to the following 23 types of business entities:

As you can see from the table above, many large organizations are well represented among the exempt. That includes financial institutions, investment brokers and dealers, investment companies and advisors, insurance companies, public utilities, and pooled investment vehicles. There’s also a general category (#21) for large operating companies.

It seems apparent BOI is targeted strictly at small businesses. Under the law, large companies have a very specific definition, and you must meet all of the following criteria to be considered exempt from filing:

- The business is otherwise subject to a federal regulatory regime.

- Has more than 20 people employed full-time within the U.S.

- It has more than $5 million in gross receipts on the prior year’s tax return filed with the IRS, not including income from foreign sources.

- It must physically operate within the U.S.

- The business is owned by an entity already exempt under the Corporate Transparency Act.

- The business is otherwise designated as exempt by the Secretary of The Treasury and the U.S. Attorney General.

Even if you believe you qualify for the exemption as a large company, check with your CPA or attorney to be certain. If you qualify as exempt, ensure you maintain adequate records for each year, proving you meet each of the six criteria.

✨ Related: How to Pay Yourself As a Business Owner

How to file a BOI Report

FinCEN has set up a webpage where you can file a report by PDF, online, or through a system-to-system API.

The report is four pages long, and most of the information requested is pretty basic. For example, you must provide the legal name of the reporting company, tax identification type, taxpayer identification number, the state you formed and registered your business, and the business address.

Reporting Company’s Ownership Interests

Next will be information on individuals with a beneficial ownership interest in the business. Beneficial ownership information includes an individual’s full name, address, and personal identification (state-issued driver’s license, state/local/tribe-issued ID, passport, or foreign passport).

You must complete 51 lines on the form, but it’s far less complicated than a common mortgage application or income tax return.

As mentioned earlier, here are the key filing dates:

- You must file your initial BOI (2024) by January 1, 2025.

- Reporting companies created or registered during 2024 will have 90 calendar days to file after receiving actual or public notice of the business creation or registration is effective.

- Reporting companies created after January 1, 2025, will have 30 calendar days to file after receiving actual or public notice of the creation or registration is effective.

Given that the reporting requirement is brand-new, we recommend you have it prepared by a CPA or an attorney, at least for 2024. If only because of the fines and potential criminal penalties, it would be better to pay a small fee to a professional and get it right the first time.

Some payroll processing companies, like Paychex, have added BOI reporting to their menu of services offered. You can also look for online services. For example, LegalZoom offers three different packages, ranging in price from $99 to $299, depending on what other services you want included.

What Happens if I Don’t File a BOI Report?

Failure to file a BOI report will result in stiff consequences. The government can assess fines of up to $500 per day, or you could even face criminal charges. The result could be imprisonment for up to two years and/or fines of up to $10,000.

In other words, you can’t afford not to file this report if required. Fortunately, the cost of complying is much less than what you may pay in fines, to say nothing of potential imprisonment.

FAQs

Do LLCs need to file a beneficial ownership report?

Unless your Limited Liability Company (LLC) qualifies under one of the 23 exemptions listed on the FinCEN website or you qualify as exempt as a large company, you will be required to file the report. The same is true for S and C corporations.

What information is required for a beneficial owner?

Fortunately, the information requirement for beneficial owners is surprisingly simple – you’ll only need to provide your full name, address, and personal identification documentation.

What is the beneficial ownership rule for a single-member LLC?

Single members who own 100% of an LLC will generally be required to file the report. However, there may be an exemption if the LLC qualifies as a large company under each of the six criteria required for that classification.

✨ Related: How to Start a Business

Bottom Line

The BOI reporting requirements will affect millions of small businesses, so until you can determine from an authoritative source that your business is exempt, you should assume that you will need to report.

This is one of those situations where the saying, an ounce of prevention is worth a pound of cure perfectly describes the situation. A couple of hours – or a couple of hundred dollars – invested now in preparing and filing the report could save you thousands of dollars in fines or worse.

Lastly, while existing businesses have until January 1, 2025, to file a report, don’t wait until the last minute. There will be enough on your plate at year-end that this requirement could slip your mind. And if it does, it can cost you dearly. File the report now, then get back to running your business.

Other Posts You May Enjoy:

Bonsai Review: Run Your Entire Business from One App

Bonsai is a business management tool that allows freelancers and small business owners to manage customer relationships (CRM) and keep track of their projects, payments, bookkeeping, and taxes. You can also use Bonsai to create and send invoices, proposals, and contracts. Does Bonsai compare to other top platforms, such as Zoho or HoneyBooks? Find out in this Bonsai review.

Novo Business Checking Review

The Novo Business Checking is an online-only checking account with an attractive fee schedule and many tools and integrations for small business owners. How does it stack up? Find out in this Novo business checking review.

Chase Business Complete Banking Review

With a wide range of small business products and services, Chase is one of the top business banks in the U.S. But can Chase Business Complete Banking compete with lower-cost accounts offered by fintechs and online banks? Learn more.

Found Business Banking Review: A Freelancer’s Dream?

Found is a business banking fintech that offers a free business checking account with integrated tools to automate various aspects of your business, from reporting to invoicing to payments, and more. Is Found right for your business? Learn more in this Found review.

About Kevin Mercadante

Since 2009, Kevin Mercadante has been sharing his journey from a washed-up mortgage loan officer emerging from the Financial Meltdown as a contract/self-employed “slash worker” – accountant/blogger/freelance blog writer – on OutofYourRut.com. He offers career strategies, from dealing with under-employment to transitioning into self-employment, and provides “Alt-retirement strategies” for the vast majority who won’t retire to the beach as millionaires.

He also frequently discusses the big-picture trends that are putting the squeeze on the bottom 90%, offering workarounds and expense cutting tips to help readers carve out more money to save in their budgets – a.k.a., breaking the “savings barrier” and transitioning from debtor to saver.

Kevin has a B.S. in Accounting and Finance from Montclair State University.

Opinions expressed here are the author’s alone, not those of any bank or financial institution. This content has not been reviewed, approved or otherwise endorsed by any of these entities.